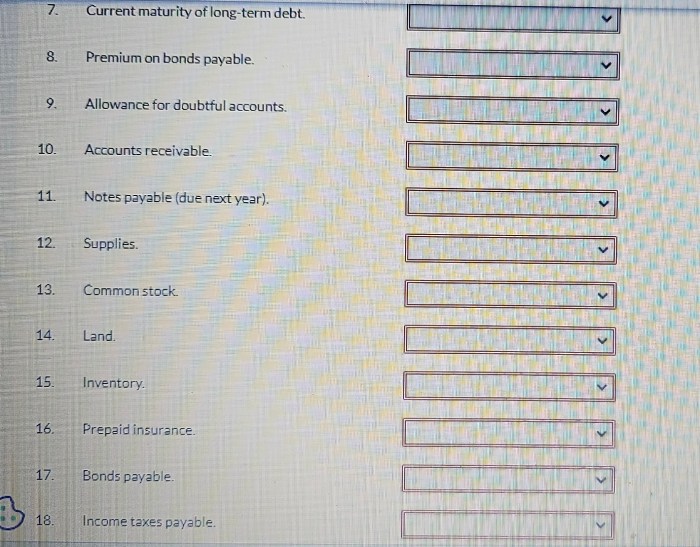

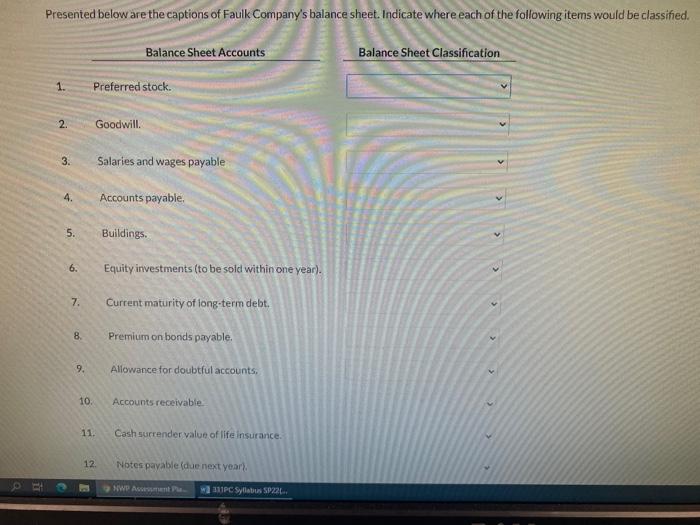

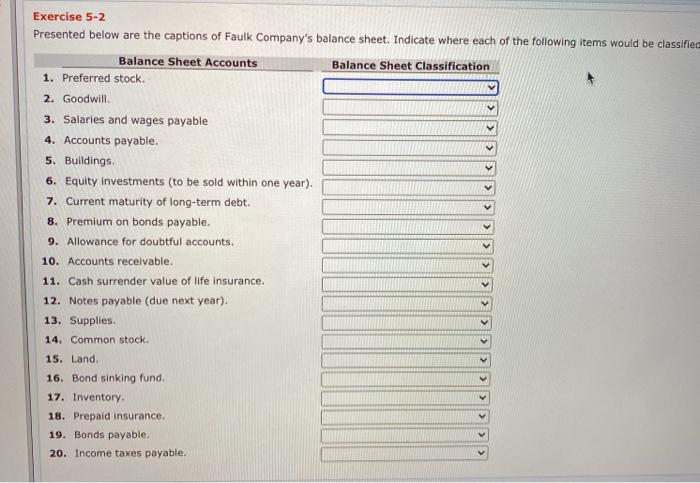

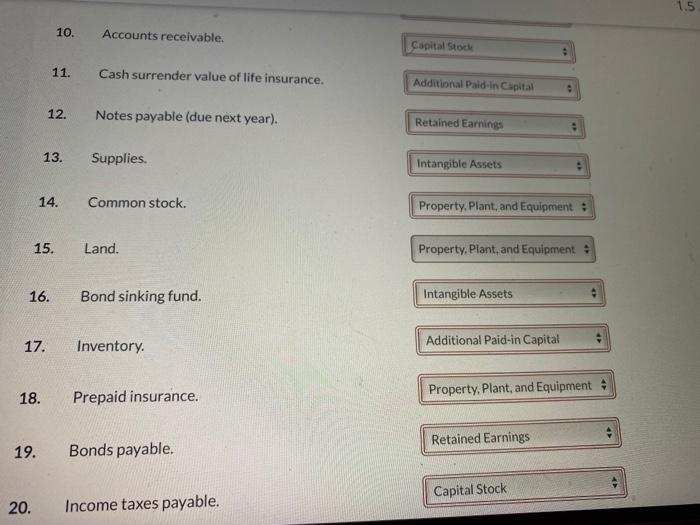

Presented below are the captions of Faulk Company’s balance sheet, providing a comprehensive overview of the company’s financial position and performance. These captions offer insights into the company’s assets, liabilities, shareholders’ equity, and other key financial metrics.

The balance sheet serves as a snapshot of the company’s financial health at a specific point in time, enabling stakeholders to assess its liquidity, solvency, and overall financial stability. By examining the captions presented below, readers can gain valuable information about Faulk Company’s financial strengths and weaknesses.

Assets: Presented Below Are The Captions Of Faulk Company’s Balance Sheet

The company’s assets can be categorized into the following categories:

- Current assets: These are assets that can be easily converted into cash within one year. Examples include cash, accounts receivable, and inventory.

- Non-current assets: These are assets that cannot be easily converted into cash within one year. Examples include property, plant, and equipment.

The company’s current assets have increased significantly compared to the previous period, indicating an improvement in liquidity. However, the company’s non-current assets have decreased, which may be a concern if the company needs to raise cash in the future.

Liabilities

The company’s liabilities can be categorized into the following categories:

- Current liabilities: These are liabilities that are due within one year. Examples include accounts payable and short-term debt.

- Non-current liabilities: These are liabilities that are due after one year. Examples include long-term debt and deferred taxes.

The company’s current liabilities have increased slightly compared to the previous period, while its non-current liabilities have decreased. This indicates that the company is managing its debt well and is not taking on too much risk.

Shareholders’ Equity

The company’s shareholders’ equity is calculated as the difference between its assets and liabilities. The company’s shareholders’ equity has increased significantly compared to the previous period, indicating that the company is profitable and is generating value for its shareholders.

Financial Ratios

The following are some key financial ratios that can be used to assess the company’s financial health:

- Current ratio: This ratio measures the company’s ability to meet its short-term obligations. A current ratio of 2 or more is generally considered to be healthy.

- Debt-to-equity ratio: This ratio measures the company’s level of debt relative to its equity. A debt-to-equity ratio of 1 or less is generally considered to be healthy.

- Return on assets: This ratio measures the company’s profitability relative to its assets. A return on assets of 10% or more is generally considered to be healthy.

The company’s financial ratios are all within healthy ranges, indicating that the company is financially sound and is performing well.

Cash Flow Statement

The company’s cash flow statement shows the sources and uses of cash during the period. The company generated a significant amount of cash from operating activities during the period, which was used to fund capital expenditures and dividends.

FAQ Corner

What is the purpose of a balance sheet?

A balance sheet provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and shareholders’ equity.

What are the main components of a balance sheet?

The main components of a balance sheet are assets, liabilities, and shareholders’ equity.

What can a balance sheet tell me about a company?

A balance sheet can provide insights into a company’s liquidity, solvency, and overall financial health.