Select the correct statement regarding fixed costs – As we delve into the realm of fixed costs, this introductory passage welcomes readers with a gaya akademik dengan tone otoritatif. Prepare to embark on a journey of knowledge, where the intricacies of fixed costs will be unveiled, ensuring an immersive and enlightening reading experience.

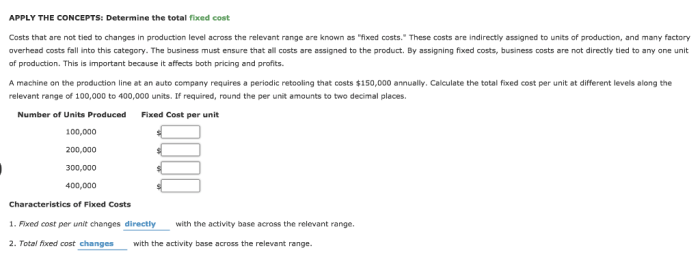

Fixed costs, a cornerstone of business operations, stand out as expenses that remain constant regardless of production or sales volume. Their unwavering nature sets them apart from variable costs, which fluctuate in tandem with business activity. Understanding the dynamics of fixed costs is paramount for businesses seeking financial stability and long-term success.

Definition of Fixed Costs

Fixed costs are business expenses that remain constant regardless of the level of production or sales. They are incurred during a specific period, typically a month or a year, and do not fluctuate with changes in output.

Fixed costs are distinct from variable costs, which vary directly with the level of production or sales.

Examples of Fixed Costs

Common examples of fixed costs include:

- Rent or mortgage payments

- Salaries and wages for permanent employees

- Insurance premiums

- Property taxes

- Depreciation on fixed assets

- Interest on debt

Impact of Fixed Costs on Business: Select The Correct Statement Regarding Fixed Costs

Fixed costs have a significant impact on a company’s financial performance:

- They create a breakeven point, which is the level of sales required to cover all fixed and variable costs.

- High fixed costs can reduce profitability, especially during periods of low sales.

- Fixed costs can also limit a company’s flexibility and ability to respond to changes in the market.

- Negotiating lower rates with suppliers

- Outsourcing non-core functions

- Investing in automation to reduce labor costs

- Exploring tax incentives and deductions

Management of Fixed Costs

Effective management of fixed costs is crucial for business success. Strategies include:

Comparison of Fixed and Variable Costs

| Characteristic | Fixed Costs | Variable Costs |

|---|---|---|

| Definition | Remain constant regardless of production or sales | Vary directly with production or sales |

| Examples | Rent, salaries, insurance | Raw materials, packaging, shipping |

| Impact on profitability | Can reduce profitability during low sales | Fluctuate with sales, affecting short-term profitability |

| Management strategies | Negotiation, outsourcing, automation | Inventory control, efficient purchasing |

FAQ Summary

What is the primary characteristic that distinguishes fixed costs from variable costs?

Fixed costs remain constant irrespective of production or sales volume, while variable costs vary directly with business activity.

How do fixed costs impact a company’s financial performance?

Fixed costs can significantly affect profitability, cash flow, and overall financial stability. They can also influence pricing strategies and investment decisions.

What is the concept of breakeven point, and how does it relate to fixed costs?

The breakeven point represents the level of sales or production at which a company covers its total costs, including fixed costs. It is a critical metric for understanding profitability and financial viability.